The cost of an off grid solar system can be quite high, depending on the components you choose. A basic 3kW solar panel with good components is about $4700. A 10kWh lithium-ion battery is approximately $9,680. A complete system which includes a battery, generator and other off-grid components can be purchased for between $15,000-20,000.

Hybrid solar systems are cheaper than off-grid solar systems

A hybrid system is a solar power system that connects to the grid and includes battery packs. Hybrid systems are more economical and offer faster returns on investment. They are also simpler to install and maintain. These hybrid systems are perfect for people who plan to switch to smart grid technology.

Another advantage of hybrid solar systems, is their ability to be more flexible. The hybrid system connects to the grid and includes solar panels, a battery, and a power meter. The panels create energy that is sent to the generator, which in turn sends it back to you. The battery can also be used to store excess energy at night. You can also use the grid's power for charging your batteries if they are low. This will further reduce your energy bills.

Flexible solar panels have become very popular

Flexible solar panels make a great choice for those who require low power requirements or who are constantly on-the-go. However, these panels are not recommended to homeowners. They are less reliable, have lower output and are generally less reliable. They also tend to be more costly and not as durable as rigid solar panel.

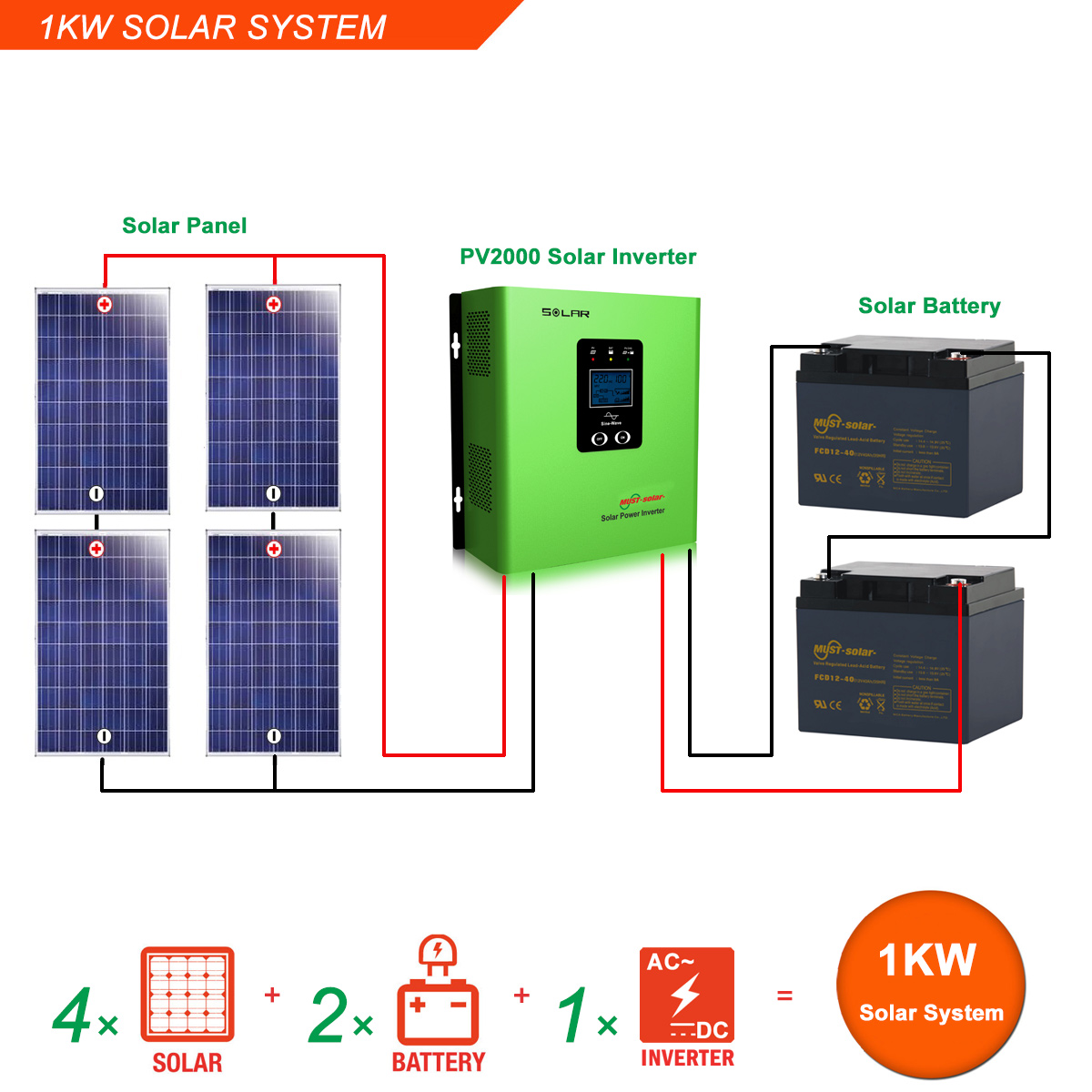

The size of a solar system will affect the cost. The output of small systems is usually only a few Kilowatts. Large systems can reach 10kW. The size of the solar system and the number if its panels will impact the amount of power it produces.

Monocrystalline or polycrystalline solar panel

Although it is impossible to resolve the issue between monocrystalline solar panels and polycrystalline, both have advantages and disadvantages. It is important to evaluate your home's needs in order to determine which type of solar panels would be best. A residential solar power solution can give you the ability to become more independent from traditional utility companies while also providing you with a reliable source for electricity.

Monocrystalline solar panels offer the benefit of being more durable with their ability last longer. These panels usually come with a warranty of 25 years. Furthermore, they perform better under low-light conditions than polycrystalline panels. They are also more pleasing to the eye. Monocrystalline panels are uniform in color while polycrystalline panels can be either blue or variegated.

MPPT controllers are the most used charge controllers on off-grid systems.

It is essential to select the correct type of charge control controller when installing solar energy systems. The most common types of charge controllers are PWM and MPPT. Both types can be used to control battery voltage in off-grid solar systems. The MPPT controller is used for systems with 12V, 24V, or higher batteries. However, there are some models that can handle systems with 48V and more.

MPPT charge regulators have a higher efficiency than traditional chargers. Additionally, they can be used in conjunction with higher-voltage sun arrays. A 12-volt battery can be charged using a larger series of solar arrays. Divide the total power of the array by its voltage, then multiply it by the maximum output in amps of the MPPT.

For off-grid installations of solar panels, tax credits and rebates are available

For off-grid solar systems, tax rebates and credits may be available. The federal government offers tax credits up to 26% on eligible homeowners. However, you must have a paper trail to qualify for the credit. Furthermore, the tax credit is not refundable, so you may only claim a portion of it. The state government offers rebates that can cut your total cost of solar system installation by 10% to 20%.

Based on the year of installation, tax credits and rebates are available. A $20,000 solar installation in 2022 for instance will qualify for a 30% tax credit. But if you install the system in 2021, the federal tax credit will only be 26%. After that, the tax credit is gone.